nanny tax calculator canada

Same rules apply for a nanny share. This is a sample calculation based on tax rates for common pay ranges and allowances.

If you have a nanny an elder caregiver or a housekeeper you likely feel a bit lost.

. Calculate pay and withholdings using the nanny tax companys hourly nanny tax calculator or. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. To determine if a treaty applies to you go to Status of.

A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. How do i pay payroll taxes for nanny. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes.

Then print the pay stub right from the calculator. As an employer you have responsibilities in the employment relationship. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

This calculator assumes that you pay the nanny for the full year. Our new address is 110R South. We let our customers do the talking.

WE TAKE CARE OF. For these wages there would be payroll source withholdings of 3314 for income tax 1268 for Canada Pension Plan contributions and 484 for Employment Insurance. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two.

This breaks down to 62 for Social Security and 145 for Medicare. Calculation of net and gross pay taxes CPP and EI amounts. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Heres an example to highlight the differences between nanny take home pay employer out of pocket expense and the nannys hourly wage based on gross pay of 600week and net pay of. NannyTax offers three domestic payroll tax plans giving you the flexibility to choose the package and price that best works for you.

Get your FREE step-by-step guide to managing Nanny Tax Payroll. The Nanny Tax Company has moved. For over ten years weve been helping busy parents along with the children of elderly parents pay their domestic payroll taxes.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Canada revenue agency cra registration. The rates of the online calculator apply only if you are a non-resident of Canada who is entitled to benefits under a treaty.

For tax year 2021 the taxes you file in 2022. As Canadas first and longest running payroll service dedicated to employers of domestic workers NannyTax manages nanny and caregiver payroll taxes and earnings for busy families across. The Nanny Tax Company has.

We have been recognized by Todays. If you hire a caregiver baby-sitter or domestic worker you may be considered to be the employer of that person. The Pitfalls of Using an Online Payroll Tax Calculator.

One of the best things about being a nanny for a nanny share is that nannies typically make more money. It will confirm the deductions you include on your. Please tick this box if you would like to receive advice and relevant news on employing and working with nannies and.

Nanny tax calculator canada Saturday April 30 2022 Edit. These rates are the default rates for employers in Pennsylvania in a locality that. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home.

Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. Paying your nanny via direct deposit. Nanny Payroll and Tax Calculator CanadianNannyca is Canadas largest and most trusted online service for finding nannies and babysitters.

If you require standard assistance our Starter package is. Canada Revenue Agency CRA registration. Nanny tax calculator for a nanny share.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

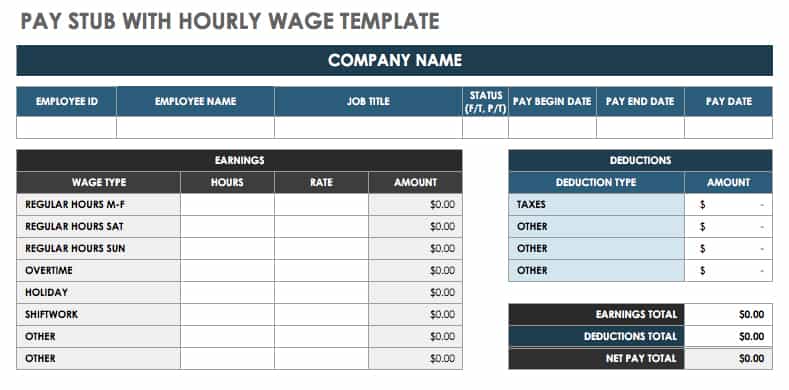

Free Pay Stub Templates Smartsheet

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

![]()

Student Tax Credits And Deductions Loans Canada

How To Avoid The Unexpected Costs Of Hiring A Nanny Nannytax

Permanent Residency Open Work Permit Canada Nanny Helper

Provision For Income Tax Definition Formula Calculation Examples

10 Tax Credits To Be Aware Of In Canada

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Payroll Quote Calculator Ayali Pay Simple Quick Smart

What Is The Payroll Calculator My Hungry Wallet

Provision For Income Tax Definition Formula Calculation Examples