salt tax cap news

The Supreme Court Monday rejected an appeal from several states challenging Congresss cap on state and local taxes that can be deducted from federal taxable income. And while its presently due to sunset in 2025 Suozzi should.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

. At least hes trying. March 1 2022 600 AM 5 min read. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

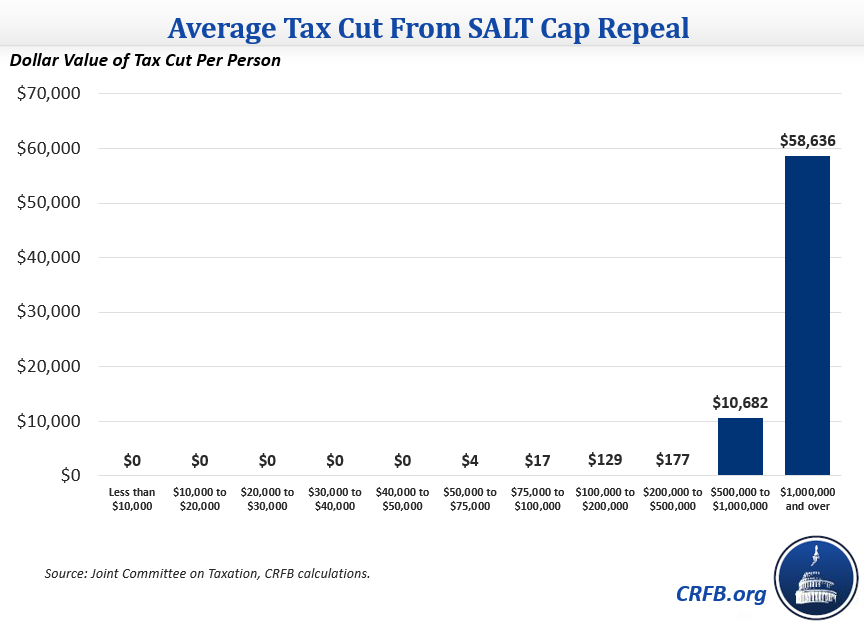

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000 and that most middle. Capitol on April 15 2021. Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax Cuts and Jobs Act TCJA.

Said at a news conference on. Enacted by the Tax. The TCJA reduced the corporate tax rate from.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. Not in these quarters. For example policymakers have proposed doubling the cap for married couples or making it more generous.

Tom WilliamsCQ-Roll Call Inc via Getty Images More On. The United States Supreme Court rejected New Jersey and other states requests to restore the full income tax deduction for state and local taxes. The Biden Administrations Build Back Better Act proposes raising the cap currently set at 10 000 to 80 000.

NBC News calls Democrat-backed SALT proposal set to help millionaires a middle class tax provision Data from the Tax Policy Center show the top 1 would benefit the most from the SALT proposal. Democrats in New York New Jersey and California have led a fight for years to repeal the so-called SALT cap which since 2017 has limited the income-tax deduction on state and local taxes. As alternatives to a full repeal of the cap lawmakers and experts have proposed a number of changes to the SALT deduction.

Seventeen states have enacted SALT cap workaround laws and several others are working towards. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. Democrats from high-tax states such as New York and New Jersey want the spending package to undo the 10000 cap on the state and local tax SALT deduction.

Organizing an LLC for your business can convert non-deductible SALT into a business expense. Americans who rely on the state and local tax SALT deduction at. According to the Tax Policy Center 16 of tax filers with income between 20000 and 50000 claimed the SALT deduction in 2017 compared to 76 for tax filers with income between 100000 and.

Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed. New York led a group including.

The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. The SALT tax deduction is. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot.

SALT Fix Not Right for Appropriations Bill Neal Says Doug Sword Tax Notes. But what is the SALT cap. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

The SALT benefit was capped at 10000 in the 2017 Republican tax law and many Democrats come from areas where the average amount of tax paid far exceeds that limit. 1 day agoPresident Bidens all but dead Build Back Better bill proposed to change the SALT cap deduction to 80000 a move that would reduce the federal income tax liability by. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

December 12 2021 930 AM 4 min read. The House bill wouldve lifted the cap starting for the 2021 tax year a boost that would have been felt when tax returns were filed earlier this year. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

The House-passed version of. Adding a provision to an appropriations bill barring the IRS from ruling against state workarounds on the 10000 state and local tax deduction cap isnt. SALT cap opponents argue the deduction.

The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions.

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Salt Tax Repealed By House Democrats The Washington Post

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How High Are Capital Gains Taxes In Your State Tax Foundation

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Millionaire Sounds Off On Calls To Lift Salt Deduction Cap Itep

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less